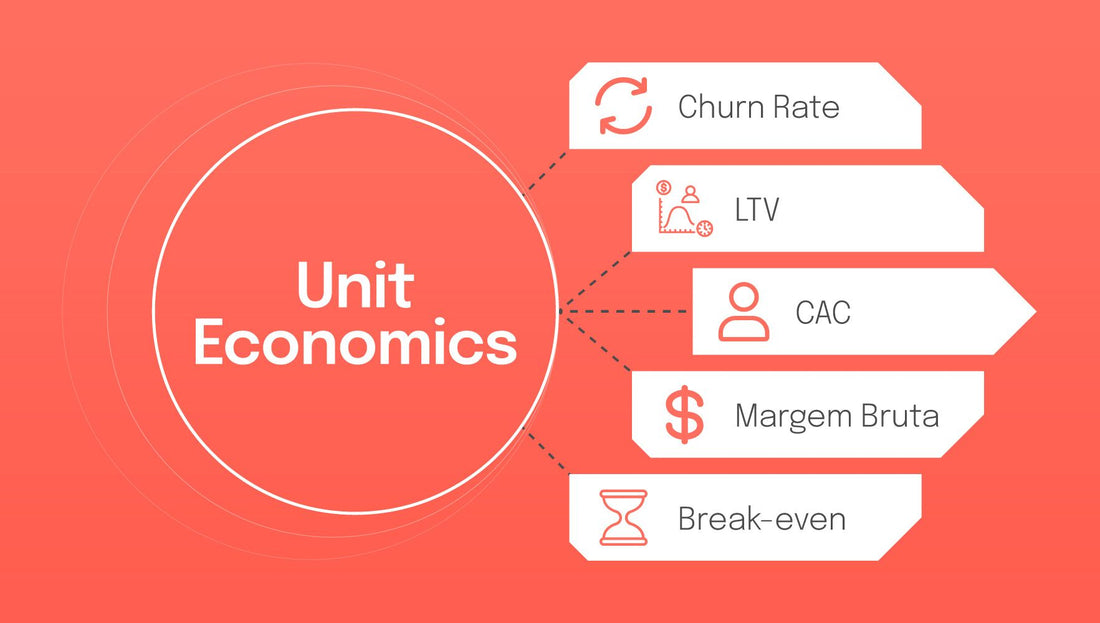

Unit economics refers to the direct revenues and costs associated with a particular business model, expressed on a per unit basis. This concept is critical for startups and established businesses alike, as it helps them understand the profitability of individual products or services. Essentially, unit economics answers the question: "Does the company make money on each item it sells or service it provides, and if so, how much?"

The analysis of unit economics revolves around two key metrics: Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC). CLV represents the total amount of money a customer is expected to spend on your products or services over the lifespan of their relationship with your company. CAC is the cost of acquiring a new customer, including marketing and sales expenses. A healthy business model typically shows a CLV that is significantly higher than CAC, indicating that the revenue generated by a customer exceeds the cost to acquire them.

For startups, especially those in growth phases or seeking investment, demonstrating positive unit economics is essential. It indicates that the business can be profitable at scale and is a crucial factor in assessing the sustainability and scalability of the business model. Positive unit economics suggest that as the company grows, it can potentially become more profitable over time.